Are you feeling apprehensive about the current state of the stock market?

It’s understandable, given the volatility we’ve seen in recent months. However, history has shown us that staying invested, and even adding more during market downturns, can yield positive results in the long run.

Here are a few reasons why you should consider staying invested and even adding more to your portfolio during market dips :-

1. Stock market uncertainties present buying opportunities:

When stocks are down, it can be tempting to sell and cut your losses. However, a market downturn can also be an opportunity to buy high-quality stocks or mutual funds NAVs at a discount.

By taking advantage of these buying opportunities, you can position yourself for potential gains when the market rebounds.

2. Time in the market beats timing the Stock market:

Attempting to time the market is a risky strategy, and it’s notoriously difficult to do successfully. Instead, focus on time in the market. Systematic Investment Plans (SIPs) – Your Superpower

- Stay disciplined with SIPs in quality mutual funds or index funds—even during market downturns.

- Benefit from volatility through rupee cost averaging. You buy more units when prices are low.

- Top Indian Mutual Funds: Consider diversified equity funds, Nifty 50 index funds, or mid-cap funds based on risk profile.

By staying invested, you give your portfolio the time it needs to recover from downturns and potentially benefit from long-term growth.

3. Diversification is key:

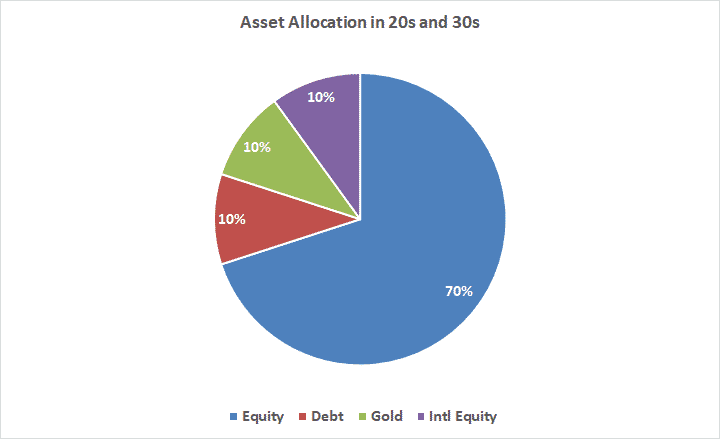

Diversification is one of the best ways to manage risk in your investment portfolio.

By spreading your investments across different asset classes, sectors, and geographies, you can help mitigate the impact of market volatility on your portfolio.

Why? Diversification across asset classes (Equity, Debt, Gold, Real Estate, International Equities) reduces portfolio risk.

Indian Context: Use hybrid mutual funds, debt funds, gold ETFs, or even Sovereign Gold Bonds (SGBs) to diversify.

Tactical Moves: Overweight defensive sectors (like FMCG, Pharma) during volatility.

4. Remember your long-term goals:

It’s important to keep your long-term investment goals in mind during market downturns. Those should be your anchor for making any decisions in the stock market.

Whether you’re investing for retirement or another long-term goal, staying invested can help you achieve those goals over time.

Moreover, adding more for short period of time with extra investment can help you achieve goals even faster as you are buying low at a heavy discount which will reward you in the future when markets go up.

5. Behavioral Edge: Control Your Emotions

- Avoid Panic Selling: Corrections Are Opportunities, Not Threats – What it means: When markets fall (say, 10–20% in a short time), investors often panic and sell at a loss, fearing further declines. This emotional reaction can destroy long-term wealth.

- Why corrections are opportunities: Valuations come down: Quality stocks become available at attractive prices. Rupee cost averaging via SIPs works better in volatile periods.

- You get a chance to buy more of the same quality businesses at lower prices. Build conviction by doing your own research or consulting a trusted advisor.

- Conviction is what helps you stay calm during market corrections and avoid knee-jerk reactions. But conviction must be based on sound knowledge and not social media tips or WhatsApp forwards.

Conclusion :

In nutshell, while market downturns can be unsettling, they can also present opportunities for investors who are willing to stay invested and remain focused on their long-term goals.

By taking a long-term perspective and focusing on diversification, investors can potentially benefit from the growth potential of the stock market. Rebalance by booking profits from outperformers and reallocating to underperformers in consultation of your financial advisor or add comment below.

Join the conversation—share your strategy for navigating market swings. Connect with fellow investors in our forum and swap insights that work.