Stock market investing has come a long way from where it began — nearly 400 years ago in Europe! What started as a way for businesses to raise money has now become one of the most powerful tools for individuals to grow their wealth.

You may hear it called the stock market, share market, or equity market — but at its core, it’s a place where people buy and sell pieces of companies.

Our parents and grandparents always told us to save — and while saving is important, just parking money in the bank isn’t enough anymore. Today, smart investing is just as important as smart saving.

This article breaks down the basics of the stock market in simple terms — how it works, why it’s important, and why people from all walks of life are turning to it to secure their future.

Whether you’re a beginner, a conservative investor, or someone ready to take bold steps, there’s a place for you in the market — and it’s never been easier to get started.

What is a Stock Market?

As the name implies, a stock market is a dynamic marketplace where stocks or shares of corporations and companies are exchanged at prevailing market prices.

Within this market, there exist both buyers and sellers of stocks. Sellers offer their stocks at specific prices, and buyers have the option to purchase a desired quantity of stocks from these sellers. In the contemporary landscape, this transactional process is predominantly digital.

Prominent examples of stock exchanges include the New York Stock Exchange, London Stock Exchange, Bombay Stock Exchange, among others.

The value of a particular stock experiences fluctuations during trading sessions, influenced by the interplay of demand and supply at any given moment.

Gone are the days when physical locations were the epicenter of stock market transactions.

Today, the buying and selling of stocks can occur with a simple click on stock exchange platforms, broker websites, or trading terminals.

Leading banks and brokerage firms offer the convenience of establishing a Demat and trading account, seamlessly connected to your bank account, facilitating smooth transactions within the stock market.

Why a company offers shares to public to invest?

It all begins when a company lays the foundation of its business, dedicating years to growth and development. The aspiration then arises to list the company on a stock exchange.

The primary motivation behind this move is to secure additional funds from both the general public and institutions. Such funds may be allocated to various purposes such as clearing company debts, expanding business operations, establishing new facilities, acquiring ventures, or even rewarding employees with stock options.

The formal process of listing a company’s stocks on a stock exchange is known as an Initial Public Offering (IPO). This marks the inaugural entry of a company’s stocks into the primary stock market.

Following a successful IPO, a company’s stocks become available in the secondary market, providing opportunities for buying and selling.

But Why should you invest in stock market?

Picture this: the timeless pursuit of wealth, a journey we all embark upon to savor life’s comforts and luxuries.

We explore various avenues on the road to prosperity—some opt for rewarding jobs, while others strive to master professions like law, medicine, finance, or technology.

Yet, at the pinnacle of wealth, lies the realm of entrepreneurship—a gateway to limitless income. The potential to amass substantial wealth unfolds when one ventures into business.

Think about the giants like Walmart, Nestle, Google, Microsoft, Apple, and Tesla—all born from the spark of a business idea.

Yet, the journey of starting and scaling a business comes with its uncertainties, inviting comparisons with the steady climb of a secure job, offering consistent year-on-year growth.

What if, I would say, you may continue with your regular income streams and become a small owner of above-mentioned companies. Not only that, you can participate as a shareholder of 50 to 100 biggest companies of your nation and even invest across the globe.

This is the prime objective of buying a stock or a share of a company by paying fraction of money of what their founders have paid, while starting the company.

What is more significant is that you are buying the ownership or equity of the company. Besides, you do not have to work for the company or devote time to grow the business in any capacity, rather, be just a loyal consumer.

Moreover, as the business of a company grows, their price of the stock also increases more or less in tandem. Additionally, many companies pay dividend to shareholders on regular basis, which could be better than your bank deposit and tax efficient too.

This price appreciation is called capital gain, if you eventually sell a stock in stock market. Whereas, it is advised to stay longer with a great company, like, mentioned above, for the greater gains.

What are the ways to invest in stock or share of companies?

So, now we have decided that we want invest in the stock market but how do we invest in stock is the next question.

Primarily, there are two ways to invest in stock market: –

- Direct Investing.

- Indirect Investing.

Direct equity or investing directly invest in stock market

As the term suggests, we directly buy the shares of a company, from a stock market or stock exchange, with the help of stock broker, as described earlier.

Fundamental Analysis to invest in stock market

Firstly, all the responsibility of selecting a particular stock or basically, a company, by way of information gathering and analyzing the data, available in the public domain.

This information is called Fundamental analysis to invest in stock market and may include, but not limited to, the following:

- Understanding the business, such as, its products, market demand, Brands, age of the business, segments it works in and more to invest in stock market.

- Its financial analysis, for instance, going through the balance sheets and profit and loss statements, to gather information about, debt situation, revenues growth, profitability trend, to name a few.

- Moreover, check the management quality and their track record, whether they were able to run a business successfully in the past, also, qualified.

- Mainly, if you can tell yourself about the company, regarding about their products, brands, how long you have been using, is it having products or services which your friends and family also endorse to use.

- Further, there is price discovery of a stock based on growth and profitability of the business, price which you will pay for one unit of stock.

This is mainly a qualitative analysis of health of a company, which should be done to invest in a stock. However, there are many other parameters on which the due diligence should be done, such as, legal or fraud matters in the company.

Secondly, there is a technical view of a stock, called Technical Analysis, based on data available, which is mainly try to predict the price of a stock into the future for a short period to invest in stock market.

Technical analysis is based on the past price trends and the volumes in a particular period from a chart of a stock. There are many probabilities and techniques, to gauge the future price movement for day, week or month.

Based on the analysis, the stock traders, take a call, whether to buy a stock or sell, if trends reflect so. However, this analysis-based stock picking is not advisable unless, you are proficient in the techniques and actively buying and selling the stocks, when trend triggers.

Indirect way to invest in Stock Market

In case, you are not well versed with the investing of financial world, there are solutions provided by different service providers, namely, Asset Management companies, Portfolio management Services and Stock exchanges.

Majorly, these service providers invest your money by charging a small amount of consultation or fund management fees.

Nevertheless, you want to invest in stock markets, following are the avenues of passive investing available in every country:

- Mutual Funds

- ETFs.

- Portfolio Management.

- Index funds.

- ULIPs.

| S.NO. | Indirect ways to invest in Stock Market | Details of passive way of investing |

| 1. | Mutual Funds | Mutual funds are the pool of investors, who contribute funds to an Asset Management company for a common objective. Where, a fund manager consolidate your money and invest in stocks by diversifying, fundamental analysis, technical analysis and different market scenarios. |

| 2. | Exchange Traded Funds (ETF) – | These are similar to mutual funds, but track a particular Index, such as, S&P 500, Nifty50, Nasdaq 100 and others and invest in stocks in similar proportions. ETFs can be traded on exchange any time for buying or selling. Generally, ETFs are low-cost investment vehicle as opposed to MFs, PMSs and Index funds. |

| 3. | Portfolio Management Services (PMS) – | This is again a service where, as per your risk profile, a PMS manager, develops a customized portfolio of stocks and invest in stocks having basis our risk profile, which could not be done in mutual funds and ETFs. There is a little higher fee in PMS, according to your expectations of returns on investments (ROI) and also, provides minimum threshold of ROI with conditions, if you so desire. |

| 4. | Index Funds – | Similar to ETFs, invests your money passively, into a particular stream or type of stocks, with a difference that Index Funds could not be traded like, stocks and ETFs, during the trading day. Also, index funds are having less cost than MFs and PMS. |

| 5. | ULIP (Unit Linked Insurance Plan) – | As the name suggests, these are the Insurance plans having a component of equity view to invest in stocks or an Index. Similar to MFs, there are generally the fund managers to manage the money, funds provided as premium by the policy holders of the Insurance plans. |

It is to be noted that securities markets are regulated an agency generally affiliated by Government of every respective countries.

For instance, SEC in U.S and SEBI for Indian capital markets, to protect the rights and interest of the investors from several risks factors and frauds.

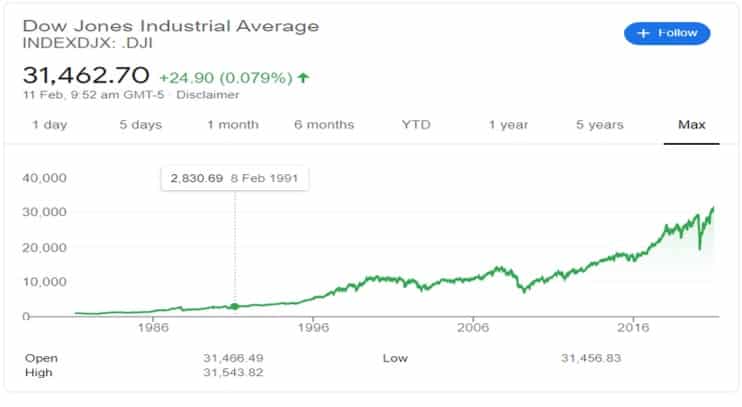

But How did stock markets perform for long period of time?

Before investing in any asset class, we should also see the past records of its performance in terms of returns on the investments we made. this is also an indicator to invest in stock market.

Here are some of the market Trends seen in last 3 decades: –

Dow Jones Index CAGR returned 8.36%

Bombay Stock Exchange, India returned 13.42%

Advantages of buying or to invest in Stock Market

There are many benefits of investing in the stock markets, but all of those advantages realized mostly, if someone is investing for long period of time, say, 7 years or more and as far as 40 to 50 years, as per their risk tolerance of the investor.

1. Get an ownership in the big corporates:

The biggest advantage of buying a unit of stock, provides you a small ownership of a blue-chip or a multinational company. Which simply means that your investments will grow as the business of that company grows in the future.

As the name suggests, buying a share of a company, brings you the part of the profits to you in the form of dividends, bonus shares, moreover, the price appreciation of the stock benefits with the capital gains, if the company is showing promise in its business.

Additionally, a shareholder has voting rights for the vital decisions of the company, over the people, who runs the corporate.

Even if you invest in an Index fund or ETF, you can get the part of ownership of multiple companies and gain as the index price of NAVs grows.

2. Best return on investments:

As explained in the earlier, stock market has been able to reward investors most in the last decades, in comparison to other asset classes.

Particularly, in the long hauls, equity brings the best returns and reduces uncertainties of the short period of times, for instance, risks of wars, natural disaster, financial meltdown, pandemics, frauds and many more.

These risks create big market fluctuations, however, over a period of time, situations are handled and people’s sentiments brought to normal, resulting in uptrend of stocks again.

3. Convenient and Cost-effective method to invest:

If you invest in real estate property and gold jewelry, there is high cost you have to pay while buying or selling of these assets. Moreover, the paper work and due diligence you have to undertake by taking help of a law professional, at even higher costs.

Conversely, you only pay fraction of the cost for the brokerage and state taxes, when you do transactions in stock market. It cost as low as 0.10% in many cases, even if buying an ETF.

4. Equity is one of most liquid among long term assets:

As mentioned in above paragraphs, equity is most convenient to transact at a click of a button, but also, there is always a regulation from security regulator that within how much time the money has to be transferred to a seller.

It varies from 1-3 days in stock transactions, while, assets like, art, land and real estate, it can take few weeks to months, before realizing 100% sold value.

5. The most Tax efficient asset:

Equity investment attracts the lesser tax liabilities than all other types of income or capital gains. This could be because the governments want to invite more capital into the stock markets and flourish corporate financing by itself.

6. Grow your money more than inflation:

If you invest most of your money in savings account, bank fixed deposits or even bonds, at most, it will provide returns equivalent to inflation rate or even lesser.

Real returns are total returns minus inflation. The saving deposits does not deliver you the protection against inflation, you need earn more than the inflation, and increase your savings to secure yourself financially from future costs of living.

Equity is an asset classes, which has provided real returns of 4-8% depending upon geographies, to the long-term investors, as it resumes the up trends after short term market undulations.

Who should invest in stock market or equities?

There are some considerations before jumping into the stock market. Your have to assess your individual situation without comparing or following other’s footsteps.

Here are some of the factors to mind to invest in stock market:

1. Know your Risk Tolerance class:

The most important factor, is to assess your risk tolerance levels against the short-term market fluctuations in the prices. Risk tolerance is the levels of uncertainty, one is willing to face, to maximize his returns. Those are divided into three levels: –

| S.No. | Risk Types | What it implies: |

| 1. | Conservative Investor | An investor who cannot take any risks against his investments and remains in bank fixed deposits for guaranteed returns. |

| 2. | Moderate Investor | An investor strikes a balance between equity and fixed returns and have moderate expectations of returns but these are more than a conservative investment by taking little risk. |

| 3. | Aggressive Investor | An aggressive risk-taking investor, will mostly be invested in risky assets, such as, equities and stocks, where, he expects high returns but, can tolerate short term downfalls of the stock markets. |

2. Willingness to learn to invest in stock market:

This is my personal take for a stock investor that he or she, who wants to invest in the equity markets, should also understand learn about stock markets to a certain extent.

There are unreliable sources of information freely available, where, if acting on those, you may face big losses, if you are not aware about the current conditions to invest in stock market.

Read books, daily business journals, blogs and can also watch business and investing T.V channels for current economic conditions, equity market trends and how to invest in stock market

Better way to start, is to invest in stock market are ETFs or mutual funds, where, there is a professional who is allocating your money in the stocks and understand their selection of stocks.

3. What are your financial goals and future events in life?

First, check whether you want allocated money in the near future say, 1 to 5 years. That is, do you have any near-term goal, where you need a sum of money, for instance, down payment for house, child education, a new car, among others.

Second, the purpose of ascertaining your up coming goals is that you may be needed money with certainty and stocks markets are never certain in the short term, so, avoid equities for short run.

However, if you want to invest for your retirements, buying house in 10-15 years, child higher education in a similar long period of time, then, it makes sense to allocate your funds towards equity allocation to maximize returns and beat inflation.

4. One who does not expect supernova returns from stock market:

Time and again, I receive calls from friends and relatives, that tell us the stock tip, which can double our investments in 6 months.

As explained earlier, stock prices of a company only follow the profitability and sales growth in a certain period and those factors generally do not double in just few months, so as the stock prices.

Consider an example of a real estate investment, do you expect to get gains every 6 months or a year from property market? It always follows the fundamental situations around it. You wait for years to double your money in property market.

Similarly, the companies take time establish and expand their businesses, moreover, a brand may take a decade to build and provide regular business from it.

So, why to expect spectacular returns from the stock market without giving it a meaningful time period.

5. One who allows money to compound over longer period:

“Compounding is the 8th wonder of the world”

said by Elbert Einstein

Extension to the previous points and to make most of compounding, we need invest regularly and for a longer period of time.

For instance, if you invest 10,000 bucks each year for ten years and rate of return expected is 10%, then you build a corpus of 175,311.67 bucks.

But if you increase the period by 5 years, the amount goes up to 349,497, which is almost double in just those additional 5 years of retaining the investments, instead of withdrawing in between.

6. One, who can start early:

As said by stock market veteran, Warren Buffet, that it is not about timing the market but time in the market.

Meaning, instead of waiting for markets to fall and invest strategy, you should invest in stock market regularly for long period of time, to get compounding effect on your investments.

To allow more time for your investments, you need start investing, as early as possible, even when your incomes are low.

You should start with the small amount and gain knowledge and subsequently, increase flows for bigger corpus of money to invest in stock market

As explained in previous point, by increasing your time horizon to invest in stock market, you can multiply your gains, exponentially. Example, there is a difference in planning your retirement in 20 years versus 40 years in your twenties.

Risks associated to invest in stock market

There is mostly a case that, if there are higher returns, then there would be some sought of risk associated with that investment avenue. Stock markets are no exceptions, below are some of the risk, of which you should be mindful, while investing in stocks:

1. Major up and down in stock prices or Market Risk:

In the short period of time markets can be volatile on either side, it may go up swiftly and go down without warning, so, short-term investors may feel trapped.

For instance, if you are investing in stocks for just 6 months, there will be chances that you may end up losing 1% to 30%, before you actually act to preserve your capital invested.

We saw just that in recent March’2020 stock market crash, it fell nearly 40% in most countries, in just a matter of few weeks due to pandemic.

2. Business Risk:

When invest in a stock, you are buying a part of a business and a business may have difficult times in sudden market situations, such as, competition, low working capital, high interest cost, change in preference of customers and many more.

Resulting, there will be an impact in the stocks of those particular businesses on downside.

3. Interest Rate risk:

Interest rates of a country are decided by its central bank, if they decide to hike the interest rates the cost of money goes up.

Resulting, it gets difficult for companies to raise funds to run and expand their businesses and may show negatively in the stock prices.

4. Inflation Risk:

Inflation is nothing but the rise in prices of products and services every year. If, due to low supply or high demand situation, the prices may go up and due to which customers may delay their decisions to buy products.

Sequentially, the low sales growth for the businesses, resulting in down trend of their stock prices in the short run.

5. Investing based on emotions Risks:

The emotions play a crucial role in investing, actually, we to avoid it all the time to invest in stock market. Markets at the extreme ends are derived by emotions like, greed and fear.

That is, greed is high when stock markets are higher and fear are high when markets are at the lowest point.

6. Economic downturns or recessions:

Economic downturns or recessions can significantly impact the performance of the stock market. During economic contractions, companies may experience reduced earnings, leading to declines in stock prices.

We need to avoid both of those emotions, conversely, we should be greedy when others are fearful and fearful when others are greedy, to gain most from the stock market, as said by Warren Buffet.

Conclusion:

You should diversify your investments into different asset classes and understand the fundamentals and risk factors before investing. Essentially, you should have risk cover of insurance for life, health and emergency fund for your survival before going to invest in stock market.

Unlock the potential of the stock market—an asset class with higher risks, yet the promise of substantial returns. While the allure of higher real returns exists, it’s essential to temper expectations; blockbuster returns seldom materialize in the short term. Avoid the pitfalls of unreliable sources and tips.

For a strategic financial journey, seek the guidance of a Registered Investment Advisor. From meticulous financial planning to crafting an effective asset allocation strategy, they are your key allies in achieving better financial goals.

Disclaimer: Above content is written for educational purposes and not a direct advice to anyone. Do consult with your financial advisor for all kinds of financial decisions.