Welcome to a New Era: Today, the traditional notion of working until your 60s is fading away. The modern dream is about relishing life, venturing off the beaten path, exploring the world, and indulging in personal passions.

As incomes soar, people are not just saving for the future; they’re creating a financial cushion for the unexpected rainy days. Disposable income has seen a surge, enabling individuals to elevate their lifestyles and immerse themselves in diverse leisure pursuits.

In this age of heightened awareness, individuals are contemplating their future choices more than ever. What do they truly want in the years to come, aiming for satisfaction and self-sufficiency throughout their lives?

Enter early retirement—a departure from the norm, liberating individuals from the conventional retirement age of 60 to 65, depending on their country.

Yet, early retirement is not just about age; it’s about achieving financial independence. It’s the freedom from working for money and the ability to sustain oneself without constraints.

So, the crucial question arises: What is financial independence, and how can one attain it early in life? This exploration will delve into the top 10 ways to achieve Financial Independence and Retire Early, unlocking the secrets to a life of freedom and fulfillment.”

What is Financial Independence?

Picture this: financial independence, the ultimate freedom to live life on your terms. It’s not just about having a stash of savings or investments; it’s the power to sustain your lifestyle indefinitely.

Imagine a bank account and diverse assets so robust that they become your lifelong companions, providing for your needs without the need to toil endlessly or seek financial aid from others or the government.

This isn’t just financial independence; it’s a path to unbridled autonomy, security, and a life where your financial foundation is as strong as your aspirations.

In fact, you are in the position to help others and the community around you for true richness in your life.

Additionally, the assets you have invested in, should also be growing with the time and not reducing to support you for the unforeseen financial crises or extraordinary future expenses.

In technical terms, your income streams consistently surpass your expenses at any given moment. These cash flows, while potentially fluctuating within a certain range, should ideally flow smoothly and securely, minimizing any significant financial risks. As a formula:

Financial Independence = Cashflows > (Expenses +inflation)

As mentioned in the formula, Inflation is also one of the important factors to ascertain the financial independence. Inflation is the average rise in the prices of services and products every year and inflate our expense budgets.

Which means that your cashflows should also be rising in tandem, to beat the effects of inflation to support your living expenses smoothly throughout.

How to Achieve Financial Independence?

As we understood that there are two main factors to achieve the goal of financial independence, which are ascertaining our expenditure and cashflow, which have to understand deeply by way of calculations and predictions.

1. How much of expenditure amount required:

To know our own expenditure, we have to make a list of expenses occurring regularly on monthly basis and then come to know about how money do we need to sustain. Here is a illustrative list of expenses of a typical household:

We need to add all the expenses as per their frequencies occurs during a particular year.

It may vary for different households, just for an idea of listing down, you may refer table, as follows:

| S.No. | Type of expenditure | Amount Per Month | Frequency (months) | Total (Amt X Freq.) |

| 1 | Rent | $1000 | 12 | 12000 |

| 2 | Grocery | $500 | 12 | 6000 |

| 3 | Gas | $400 | 12 | 4800 |

| 4 | Vehicle Insurance | $1000 | 1 | 1000 |

| 5 | Electricity | $200 | 12 | 2400 |

| 6 | Phone Bills | $100 | 12 | 1200 |

| 7 | Life Insurance | $1000 | 1 | 1000 |

| 8 | Health Insurance | $500 | 1 | 500 |

| 9 | School Expenses | $100 | 4 | 400 |

| 10 | Dine-outs | $200 | 12 | 2400 |

| 11 | Home Internet | $50 | 12 | 600 |

| 12 | Electronic items | $400 | 1 | 400 |

| 13 | EMIs (Excl. mortgages) | $400 | 12 | 4800 |

| 14 | Clothing | $200 | 2 | 400 |

| 15 | Vehicle Maintenance | $200 | 1 | 200 |

| 16 | Miscellaneous | $500 | 1 | 500 |

| Total | $ 38600 |

So, it is ascertained from above calculation in the table, that a household may require above $38600 amount for a year, all the time in the readily available form for survival.

The type of expenses and amount spend will be different for different countries, above table only illustrates basic form of listings.

This total amount should be added with inflation rate each year till the time you want to get retired and see what should be the monthly expense requirements that time.

For instance, if we add inflation, to the above mentioned figure of $38600, by 5% p.a, after 20 years a family would be needing $83,263 per year.

Now, when we have calculated our expenses and added inflation to come to a amount which will be needed after 20 years to be able to sustain and live our life and get retire.

We have to talk about, how much to save to retire early and invest, to get to that amount, which will fetch those kinds of cashflow for sure.

2. Create a Financial Independent Plan

In our example of retire early in 40s and start planning right into your 20s will help far more than to start savings in mid 30s. First, we have to get to that a corpus of money in our bank, which will enable us to withdraw the said amount every month.

If the assumed the rate of return of 8% p.a. from a fixed or debt scheme portfolio and bit in equities, with low risk and moderate returns, what will be the corpus of money required at the age of 40?

The answer to that question is approx. $1,040,788. Which means one has to build a corpus of over a million dollar in a span of 20 years.

3. How much one has to save & invest?

As there is good time of 20 years to invest and grow the money, we can assume a rate of return of 12% by investing in well diversified portfolio across different assets classes.

Asset allocation to outmost important in investment planning, where you understand the different asset classes such as, equities, gold, real estate, bonds and others with respect to their risks and returns, then match with your risk profile to start investing.

If someone is investing on monthly basis, he has to invest minimum of $1200 per month for next 20 years without fail, to reach to the target of over a million dollars.

Now, when we know how much total amount required to be financially free, and get to the dream of Financial independent retire early. We have to select the assets and investments where on

Thus, you need create a portfolio of different assets to allocate the income, through diversification process.

Also read: How to increase your savings

4. Creating an Investment Plan for financial independence:

One and only rule you should follow while investing in different assets for portfolio diversification is to have low or no correlation between those assets.

Imagine your investments as a team where everyone has a unique role. Ensuring little to no correlation between these players, means they won’t all move in the same direction—protecting your game plan.

Picture this: if the stock market takes a hit, other team members like gold and bonds might step up, or at least hold their ground, shielding your returns from a one-way plunge.

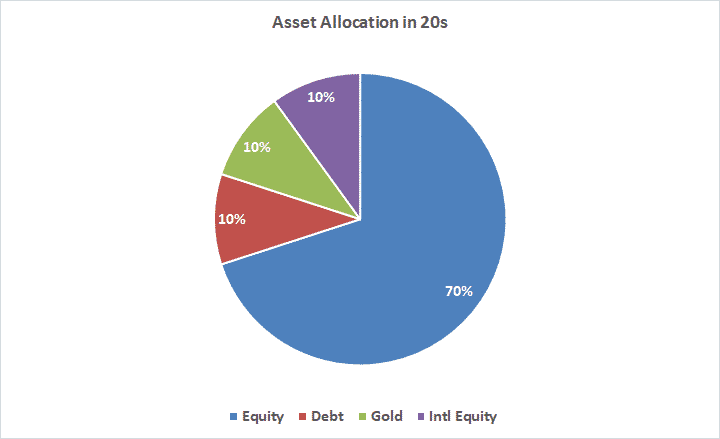

In your twenties, when financial responsibilities are on the lighter side, you can afford to let your star player, equities, take the lead with a sizable 70% to 80% exposure. It’s like putting your money where it can take some risks while aiming for the big wins.

In this age group the asset allocation may look like as below:

For the required amount of $1200, you have to invest $1000 each month in diversified equity mutual fund and rest $200 in debt and gold ETFs or Index funds:

| Type Of Asset classes | Allocation |

| Equity | 70% |

| Debt | 10% |

| Gold | 10% |

| Intl Equity | 10% |

This asset allocation will almost ensure the required 12% rate of return over a period of 20 years, for more than a million dollars.

Also read How to do best asset allocation.

5. Frugal Living for early financial Independence:

- Embracing a frugal lifestyle to maximize savings:

- As mentioned previously, boosting savings and investing for long-term returns can exponentially grow your wealth over time. Exercise caution in spending on non-essential items and depreciating assets such as cars and electronics.

- An effective way to gauge unnecessary spending is to reconsider loans for purchases; avoiding loans for items with diminishing value is prudent. Home loans, however, can be a sensible option as they contribute to asset-building by eliminating rental expenses.

- Tips for cutting expenses without sacrificing quality of life:

- Prioritize needs over wants, identifying non-essential expenses that can be trimmed while maintaining essential comforts.

- Embrace a minimalist mindset, decluttering both possessions and spending habits to align expenses with genuine life priorities to retire early.

6. Factors to Consider

- Every household may be having different expenses and retirement amount expectations, based on their lifestyles. Here are some of the factors to consider while creating a financial plan for early retirement

- Mortgage payments are not taken into consideration, because when you start investing money in 20s you should save for the bigger down payments as much as possible.

- Not tying up significant sums of money in large-ticket items such as property can preserve liquidity, preventing it from being immobilized.

- This liquidity, when available, can be channeled into high-return investments like equities, allowing for more dynamic and potentially lucrative investment opportunities.

- Keeping funds fluid ensures flexibility and the ability to capitalize on market opportunities, contributing to a more agile and responsive investment strategy.

So that, you do not end up paying much more than the buying price of the property.

- The required amount of $38600 is being considered for a moderate expenditure household with medium type income levels.

However, you think that the monthly expenses require more, then you may increase the amount and subsequently, the required amount after 20 years and the investments for next 20 years will increase proportionately.

- In countries like, India, by ignoring the dollar sign from the above required amount, similar investment plan would be needed to invest and to reach to the retirement at the age of 40.

7. Look for F.I.R.E (Financial Independence Retire Early) communities & people

In the realm of Financial Independence, Retire Early (FIRE), real-life success stories and case studies serve as powerful beacons of inspiration and practical guidance.

These narratives feature individuals from diverse backgrounds who have navigated the journey to early retirement successfully.

By spotlighting their strategies, milestones, and the financial decisions that propelled them toward FIRE, these stories provide actionable insights for others aspiring to achieve similar goals.

The focus extends beyond financial metrics to include the challenges faced and overcome, illustrating the resilience required on the path to financial independence.

Case studies delve into the specifics, offering a granular understanding of the tactics employed for early retirement.

They dissect financial strategies, investment choices, and lifestyle adjustments that contributed to the realization of FIRE goals.

Through these studies, the aim is to distill valuable lessons, inspire others in their financial journey, and foster a community of individuals committed to attaining financial independence and retiring early.

Conclusion:

Postponing retirement planning by several decades can substantially increase the challenges of achieving early retirement.

Commencing investments in your 20s for financial independence and early retirement proves advantageous, leveraging the luxury of time and fostering the potential to transition from active investing while still reaping the benefits of continued investment growth.

It’s crucial to emphasize meticulous planning for both expenses and investable amounts, coupled with the initiation of investments early in life, even if in modest increments annually.

This approach establishes a disciplined financial strategy over extended periods, laying the foundation for achieving ambitious financial goals with dedication and potentially transformative outcomes.