Earning good money is one thing but preserving and growing your hard-earned money is different ball game altogether, most of the people are not aware, because it is not taught in the schools.

Most of the people strive to earn income through service and small businesses and always seek opportunities to increase your savings, which is a great thing to do in your working life.

However, most of this hard earned money is being deposited in the banks with low interest incomes or invested in traditional investment avenues like, bank fixed deposits and life insurance saving plans.

All those options are good options to preserve your money but fail to provide meaningful returns on investments or even beat the inflation.

Resulting, your money value over a period of time diminishes and negatively affects your financial goals. Herewith, we will discuss about option of Index Funds Vs Mutual Funds for best return on your money invested.

How to grow your money by Investing ?

To grow your money, you should diversify your investments across the investment classes to minimize risk and extract growth from asset allocation and not lean towards one of the asset class only.

There are many investment avenues available for you to invest and diversify your money investments, such as, bank deposits, real estate, bonds, stock market, money markets and insurance saving plan, also called as endowment policies, to name a few.

The combination of above said different asset allocation of your funds, which helps in diversification of your investments.

This diversification of investment, provides you the best of both worlds, that is, growth from stock market and real estate, and money safety from bank deposits and insurance plans.

However, you should make be aware of different assets and their characteristics by learning about those and how much to invest in different assets to make a balance between safety and growth of your investments.

The balance of investments is largely depending on you risk profile and financial goals, which is also the basis to invest your money at a first place.

That is, you should not be too conservative while investing and take little risk to fulfil your goals, as well as, you should not be taking unnecessary risks by investing in riskier assets beyond a point, under the influence of greed.

What is Direct and Indirect investing in the stock market?

While investing your money in the stock market, you have got two ways to invest in it:

- Direct Way by investing directly in the stocks and other securities through Demat and Trading account.

- Indirect way of investing, through ETFs, mutual funds and Index funds, who collect money from you and invest it the stocks best suited according to your investment objectives by performing fundamental, market and technical analysis.

All these analyses are being performed by the fund managers, who are well qualified and experienced in the field of investing and finance, by charging a fee.

We are primarily going to discuss about mutual funds and index funds, which are both indirect ways to invest in the stock and debt markets.

What is Active and Passive way of investing? E.g.(Index funds Vs Mutual Funds)

Active way of investing is where efforts are being made to get better returns, than the underlined index, such as, stocks and mutual funds, where you or your investment advisor or fund managers in case of mutual funds, with their experience and related qualifications, strive to beat the market for you.

On the other hand, there are other passively managed investment funds, where you can invest via. ETFs and Index funds.

Which hardly require a fund manager but matches the stocks listed under the different indexes, but does not mandate to beat the index in terms of returns.

What are the major differences of Index funds Vs Mutual funds?

| S.no. | Parameter | Mutual funds | Index funds |

| 1. | Objective | To beat the respective Index through selection of stocks. | To track the targeted index and avoid any deviations or tracking errors |

| 2. | Fund Management | Funds are managed by fund managers to select best stocks | Fund manager only tracks the underline index and do not deviate |

| 3. | Stock selection | Best of the stocks are selected according to the fundamentals analysed by fund manager. | Invest in the stocks proportionately to the volume present in the underline Index, like, Nifty50. |

| 4. | Volatility | Here portfolio may present less, more and similar volatility to the underlined Index, it is based on. | Volatility here is almost not present because the returns are almost equal to the Index. |

| 5. | Charges | There is an additional funds manager charges here, to provide stocks analysis services. | There are low charges here as compare to MFs, because fund manager only tracks the index. |

| 6. | Risk involved | Here the risk is little bit more than the index funds, as fund manager takes the decision to invest or avoid any stocks. | As compare to the underline index, the risk is almost equal to the overall market, if there are no tracking errors. |

| 7. | Transaction volumes | MFs involves more transactions, as fund manager buy or sell stocks according to the market and fundamental conditions of the stocks and takes decisions. | Here, unless there are changes in the main Index itself, fund manager does not buy or sell the stocks and maintain positions. |

Index funds Vs Mutual funds, which one is the best for you?

There can one or both in the combination of above, may be best suited for your investment planning. You should be aware of the risk involved and financial goals requirements, which you have set for yourself.

For whom is the Mutual Funds investment?

There are several mutual funds schemes spread over different categories, moreover, you may opt for equity, debt, hybrid, gold funds and asset allocation funds, to name a few.

- You should be little knowledgeable when it comes for mutual funds investment, to understand the risks and suitability to your investment objectives.

- You may have to be ready to perform little research for the selection of the MF schemes from different websites, before investing, even if you hire a MF advisor.

- As mentioned in the comparison, an MF scheme may give returns which could more, less or even similar to an index.

Which simply means, mutual funds are little more volatile due to the objective of getting more returns than an Index returns.

- If you are investing in an equity MF, one has to be ready for little more risk more than the underline index, on which it is based on, because fund manager will try to achieve better returns than an index resulting taking bit more risk in the process.

- You may have to analyze the performance of the mutual funds schemes you have invested from six months to at least a year.

If required, if the returns are not up to the mark, you can change the scheme in the same category after observing its performance for two to three years.

So, if you are little aware and having interest in the investing world and in the stock market and increase your knowledge for life time then you can invest in different schemes of mutual funds, even if you are being facilitated by a mutual fund advisor.

For whom are the Index funds?

Index funds are based on the respective underline indexes which it is targeting, with the convenience of investing, just like, mutual funds. You can expect the similar returns that of an index or ETF.

For instance, if your index fund is based on Nifty50 index then the returns will be similar to what the main index will provide, in terms of price movement, subject to any tracking error.

Here are some of the reasons to invest in the index funds and whom should invest in those:

- You are someone who knows the benefits to invest in the stock markets and other financial securities, but do not know how to invest, hence, you start investing in the index funds.

- You do not track the mutual funds or stock market and do not know what decisions to take for buy and sell.

- You want the diversification of your investments and do not want fund managers to take unnecessary risks on your portfolio to provide more returns, because most of the mutual fund schemes fails to do so.

- You do not have time to learn or interest in the financial markets and leave it to the vanilla index to grow your money, because it provides automatic diversification by investing in different sectors and stocks.

- You do not want to do experiments with your investments or strive find alpha, in different type funds, rather, invest regularly and stay invested for longer period of time to grow your money.

- However, you are aware that most of the funds, especially, large caps, are not able to beat the index funds in the span of ten or more years.

- Finally, you do not want to incur more cost of transactions while investing and retaining the mutual funds, where, charges vary from 0.90% to about 2%.

- Whereas, the charges are miniscule while investing in an Index fund, those are between 0.10% to 0.50%, because there are no fund manager fees involved.

Strategy of investing the combination of Mutual fund and Index fund

As you have come to know that which option is best for you, but still, you want to venture out in both the options to maximise your returns on investments.

Here is a strategy to take most of the benefits by investing in both the way of investing in the financial market.

You will get best of both the world by investing in the combination of the both investing avenues.

That is, benefit of passive and low-cost investing in index funds, as well as, strive for better returns by investing in suitable mutual funds schemes. Also read: Best mutual funds of 2021

What are the Large cap Mutual funds returns in the past?

As per long term past returns from the large cap mutual funds schemes, those have hardly beaten the underline index on consistent basis or by a good margin.

So, for the large cap category of the market, it is better to invest in an Index fund rather than in a large cap mutual fund scheme.

Because large cap funds are just able to provide marginally better returns than index funds in the long term, but will cost more for transactions and ownership.

Best large cap fund performance against the index is shown in the table below:

| YTD | 1-Day | 1-W | 1-M | 3-M | 6-M | 1-Y | 3-Y | 5-Y | 7-Y | 10-Y | |

| Axis Bluechip Fund | 24.1 | 0.36 | 1.18 | 7.46 | 13.32 | 20.67 | 52.11 | 20.41 | 19.49 | 16.29 | — |

| S&P BSE 100 TRI | 28.38 | 0.6 | 1.58 | 6.8 | 12.05 | 19.63 | 54.7 | 16.35 | 16.2 | 13.65 | — |

| Equity: Large Cap | 28.75 | 0.59 | 1.67 | 6.9 | 12.15 | 20.31 | 54.24 | 15.85 | 15.34 | 13.62 | — |

| Rank within category | 64 | 74 | 77 | 16 | 12 | 28 | 48 | 2 | 1 | 2 | — |

| No. of Funds in category | 71 | 81 | 81 | 80 | 77 | 73 | 67 | 57 | 49 | 49 | 0 |

Scenarios of investing in mid and small cap through mutual funds

On the other hand, data shows that in the event of investing in mid and small cap mutual funds, those have beaten the respective index of the category by a good margin.

| YTD | 1-Day | 1-W | 1-M | 3-M | 6-M | 1-Y | 3-Y | 5-Y | 7-Y | 10-Y | |

| Axis Small Cap Fund | 52.56 | 0.02 | 2.01 | 8.83 | 18.43 | 36.32 | 75.79 | 30.76 | 23.29 | 21.27 | — |

| S&P BSE 250 SmallCap | 52.43 | -0.02 | 2.12 | 6.54 | 12.16 | 29.03 | 80.41 | 16.7 | 15.16 | 13 | — |

| Equity: Small Cap | 56.56 | 0.1 | 1.92 | 6.83 | 14.82 | 34.64 | 82.39 | 21.99 | 18.73 | 18.83 | — |

| Rank within category | 20 | 19 | 11 | 3 | 3 | 9 | 20 | 2 | 3 | 4 | — |

| No. of funds in category | 26 | 28 | 28 | 28 | 27 | 26 | 24 | 14 | 13 | 13 | 0 |

Thus, you are able to get much better returns in these categories of the mutual funds that covers up you cost incurred during transactions or yearly fee.

What proportion should I invest in an Index fund and mutual fund?

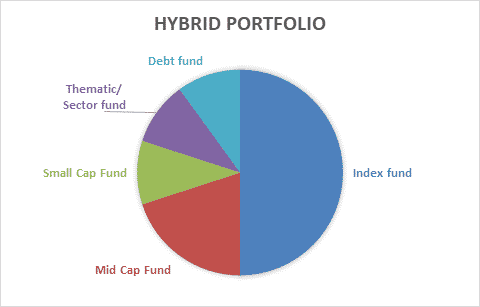

As you understand now, an index fund is comprised of large cap companies, should be invested in as the core while creating an equity portfolio, having larger portion of at least 50% or more according to the risk profile.

Rest of 0% to 50%, can be distributed into the mid, small cap and thematic mutual funds schemes, in the expectation of better returns in the long term, as compare to the respective underline index.

Additionally, as a small percentage say, 10% to 20% of the portfolio can be invested in the debt funds for the stability and a reserve to be able to invest at down side of the markets.

Here is a depiction of the portfolio of the combination of the index and mutual fund portfolio:

Conclusion:

Mutual funds are one of the best ways to invest in the stocks, bonds, gold and other financial assets, due to fund manager’s professional research and experience capabilities.

However, over the last years, index fund in the large cap category has shown best of the returns and low cost preposition for the investors along with the ease of investing and staying with it for the long period without the hassle of analysing markets.

On the contrary, in the mid and small cap categories, the mutual funds are able to provide much better returns to the investors in the long term as compare to the underline index.

Most importantly, you should asses your risk profile and return expectations before investing, especially, in the stock market. Also, if in doubt, do consult with your financial advisor for your financial goal planning for the true implementation of the investment plan.

Which option do you prefer, Index fund or a mutual fund or an ETF?