Diversifying your investments across various asset classes is a time-tested strategy endorsed by renowned investors. However, this requires not only profound knowledge but also a continuous commitment to learning and adapting in the ever-changing investment landscape.

The age-old advice of not putting all your eggs in one basket perfectly applies to the investment domain. To craft a well-rounded investment strategy, delve into the intricacies of different investment instruments.

Align your choices with your risk tolerance and investment horizon, ensuring a judicious allocation of your hard-earned money.

Think of investments as a balanced diet, where your portfolio resembles a plate filled with diverse dishes, each representing a different asset class. In our discussion, we’ll explore various asset classes and their significance in building a robust investment portfolio.

Crucially, achieving the right balance in your portfolio diversification involves determining the proportion of different asset classes. This balance aims to maximize returns while mitigating potential risks associated with each asset class.

Yet, amid traditional choices, there’s a surge in alternative investments fueled by rapid technological advancements. While these may seem alluring, it’s essential to note that these alternatives, despite their instant success, pose higher volatility and risk due to their limited historical track record.

1. Different Categories of Investment Asset class

There are different categories of investments classes available for portfolio diversification, which can be pursued by investors, depending upon their preference, such as, risk tolerance, return expectations and investment period, for which they can remain invested.

Here are some of the categories of investments based on the investor’s behavior and preferences:

| Categories | Definition | Target Investment Options |

| Conservative | Here you invest to protect your investments and may get small returns due at almost no risks. | Fixed deposits, Government securities, Debt Funds: short and long term and Bonds |

| Moderate | You invest here, with little risk but returns are much more than conservative investments, it helps to compound your investments. | Bonds, Fixed deposits, Hybrid Funds, Long term Debt Funds and corporate bonds, debentures and Gold. |

| Growth | You have got time on your side or decades, to grow your money, you invest for growth of your investments by manifold, however, with risks in short term periods | Stocks, Mid and Small Cap mutual Funds, Index Funds, Real Estate and Gold. |

To consolidate the list of investment classes available, are mentioned below, from which you can choose different assets for portfolio diversification, according to your preferences, knowledge and time for which you want to invest:

| Types of Asset classes | Risk Associated | Time Period Suited |

| Equity | High | Long Term |

| Bonds | Moderate | Medium Term |

| Debt Funds | Moderate | Short Term |

| Bank FDs | Low | Short Term |

| Gold | Moderate | Medium Term |

| Intl Equity | High | Long Term |

| Real Estate | Moderate | Long Term |

| Commodities | High | Medium Term |

Takeaways:

- Above matrix should be used from all the angles related to the financial goals as a centre point, you have made for yourself or your family.

- All the financial goals should be ascertained according to time period and risk you are willing to take to get better returns. Longer the period better the returns.

- This is the generalized presentation of the asset classes and their risk associated with it and the time horizon suited for most of the people for portfolio diversification.

- There could be exceptions, for instance, a person may be willing to take higher risk in equities, even in short period of time, say, few months to a year for tactical ploy.

- On the other hand, some may not take even little risk a financial goal, which is decades away, such as, your retirement.

- Commodities should be seen as cyclical investment and may not suit for a long-term asset class, due to their nature of price ups and downs after every 3 to 5 years.

2. Defining Equity as an Investment Class

The equity asset class appeals to a diverse range of investors, particularly those seeking to build wealth and achieve portfolio diversification over an extended period through the compounding effect.

Individuals embarking on their careers or even in their forties stand to benefit significantly from investing in equity markets to maximize returns and allocate a substantial portion of their investments to capitalize on the expanding economy.

In this discussion, we will explore the overarching view of stock markets and the associated advantages, emphasizing their integral role in achieving effective portfolio diversification.

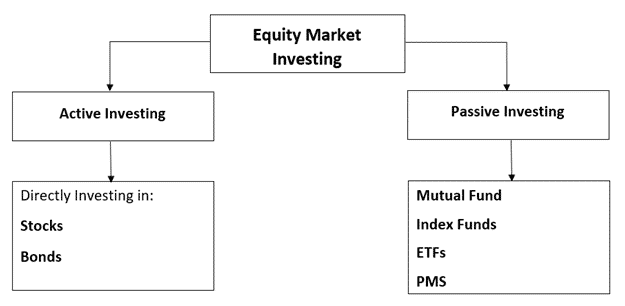

First, we should know that there are two ways to invest in stock markets, according to your knowledge level and willing to invest time to understand the equity asset class:

Above is the structure of different ways to invest in the stock markets. As per your convenience and knowledge, you can choose the path to invest in equities through active and passive investing routes.

There is no perfect way to invest, because most of the investors, even pros, invest with the combination of active and passive ways of investing in the stock market, to limit risks.

The biggest difference between the active and passive investing is your risk transfer ability, that is, in active investing, all the risk is associated with your own decisions while buying and selling of securities.

Thus, you should be aware of so many macro and micro fundamentals of the stocks and industries, you want to invest in. Read: How to become successful Investor.

Whereas, under passive investing, you only allocate fund to the fund manager, who takes decisions to invest in the stocks and bonds for you. The fund managers are well qualified to handle large information and utilize the same for your benefit of return on investments.

3. How to build a Portfolio?

Constructing a portfolio stands out as a paramount aspect of anyone’s investment journey, surpassing even the significance of selecting the ideal stocks or mutual funds for achieving diversification.

Portfolio diversification involves blending various asset classes to create a well-rounded investment strategy, aiming for low risk and high return expectations.

This encompasses a diverse array of financial assets, including stocks, mutual funds, bonds, commodities, index funds, ETFs, and cash equivalents.

Furthermore, a comprehensive portfolio extends beyond traditional financial instruments to encompass real estate, art, and other private investments such as vine collections or antiques, contributing to further diversification.

In our discussion, we will delve into some prominent asset classes among those mentioned above and explore situations in which they are applicable for investors.

This approach enables you to establish a harmonious balance across your investments in different assets, aligning with your risk profile, financial goals, and the principles of portfolio diversification.

Things to keep in mind while selecting assets for portfolio diversification.

One of the most important rule you should follow while investing in different assets for portfolio diversification is to have low or no correlation between those assets.

Resulting, no or less correlation between the assets you are investing, will make sure that your portfolio returns are not going in one direction, that is, all the assets you are having, are not going down or going up at the same time.

For instance, if due to negative economic scenario, equity markets go down, other assets like, gold and bonds, may go up or at least remain flat and your downside of returns are protected, instead of investing 100% in equities.

Similarly, real estate market may also behave negatively with respect to stock markets at a given period, due to the reason that investors pulling money from risky assets and invest in safe heavens where there is less fluctuation in the prices.

This way, your investments portfolio diversification will be protected from the downside from a single asset class and enable positive returns from other assets classes in the same period to maintain a balance and risk mitigation.

4. What is Correlation?

Correlation, as you know is the relation between two things, wherein, their characteristics may or may not match, even if present in same situation or group.

Technically speaking, correlation between two given assets should be ‘0’ or even negative and perfect correlation is equal or near to ‘1’.

To understand more about correlation implies, the correlations exhibit how closely the price movements of two asset classes are linked. For instance, here we consider two asset classes A and B:-

- If price of asset class A rises by 10% and asset class B also rises 10%, then they have a perfect positive correlation of 1.

- If price of asset class A rises 10% and asset class B does not change, the they have no correlation.

- If price asset class A decreased by 10% and asset class B increased by 10%, the they have a perfect negative correlation of -1.

To make it clearer, we will find out from below mentioned matrix, how different assets are correlated in the past for portfolio diversification: –

| Assets | Commodities | Bonds | Real Estate | Equity |

| Commodities | 1 | -0.17 | 0.34 | 0.20 |

| Bonds | -0.17 | 1 | 0.38 | 0.53 |

| Real Estate | 0.34 | 0.38 | 1 | 0.62 |

| Equity | 0.56 | -0.05 | 0.62 | 1 |

| Intl Equity | 0.15 | 0.005 | -0.001 | 0.52 |

5. Model Portfolio, as to how a Portfolio of Assets can be build

The combination of the different assets in the portfolio should be based on your requirement, return expectations and risk profile and not necessarily on the basis of number assets you should have.

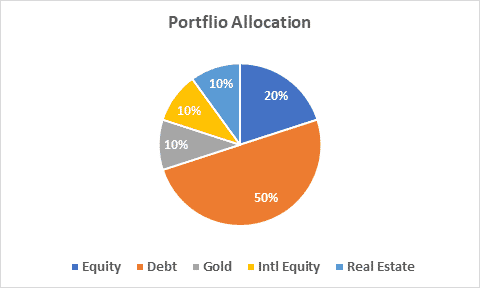

Take an example of an individual of say, middle aged person, having ideal portfolio according to the risk profile. The graphical representation of his portfolio is given below:

| Type of Asset classes | Allocation |

| Equity | 50% |

| Debt | 10% |

| Gold | 15% |

| Intl Equity | 10% |

| Real Estate | 15% |

Asset Allocation by Age

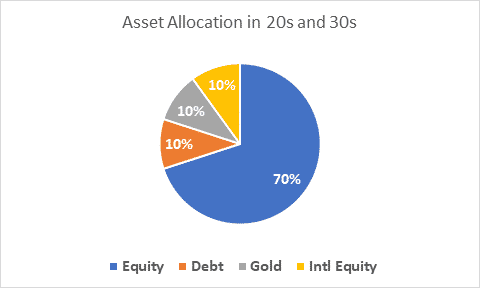

Your age is one of the critical factors while investing in different assets and reducing risk in coming future through your portfolio diversification.

- While at the age of 20 to 30 years, you may take sizable exposure in equities between 70% to 80%, as you do not have much of the financial responsibilities and may take higher risk with your investable amount.

In this age group the asset allocation may look like as below:

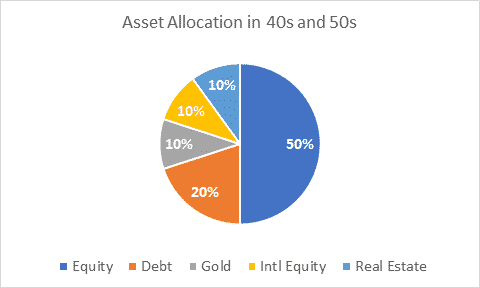

- As your grow to the age of 40s and 50s, the equity allocation may go down, due to the fact that you need stability of your finances, to be able to get to the desired retirement funds.

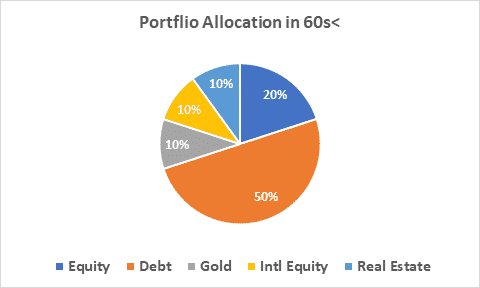

- Although, it depends on the individual and his risk-taking abilities, at the age of 60 and onwards, it is prudent to reduce the equity allocation to the minimum, say, 20% to 30% at the extreme and maximum allocation goes to the debt or fixed deposits and pension funds as portfolio diversification tact.

Here a person needs regular income and predictable returns on the invested capital:

6. Portfolio Rebalancing for stability

Once you have decided on the portfolio diversification of your investments, you have to maintain that balance in the future.

For instance, after a year of implementation of your asset allocation, one of the assets have increased in value due to extraordinary surge in the prices in the market, such as, value of real estate then you have invested in.

Resulting, there will be an automatic change in allocations due to increase in share of an asset. To maintain your allocation in different assets, you have to sell that asset a little, which has improved its value a bit and invest in the assets which have lagged behind.

Thus, this way you will periodically book profits and invest in the lower level of another asset’s prices for better returns in the future.

For example, due to increase in prices of the equity markets your asset allocation in above chart, went from 50% to 55% in a year. On the other hand, Gold has lost its value by 5% during that period.

The remedy of the above disturbance in portfolio diversification, you may have to sell some stocks or mutual funds and buy a quantity of gold through ETF or Gold bonds for quick purchase.

7. Common mistakes to avoid for portfolio diversification:

A. Overconcentration in a Single Asset:

One common mistake is overconcentration in a single asset, meaning investing a disproportionately large portion of one’s portfolio in a specific investment.

Diversification helps mitigate this risk by spreading investments across different asset classes, reducing the impact of poor performance in any single investment.

B. Ignoring Changing Market Conditions:

Another mistake is ignoring changing market conditions. Regularly reassessing your portfolio and making adjustments based on the evolving economic and market landscape is crucial for maintaining a well-balanced and resilient investment strategy for portfolio diversification.

C. Emotional Decision-Making:

Emotional reactions can result in buying high and selling low, which is detrimental to long-term investment success. It’s important to cultivate a disciplined and rational approach to investment decisions.

Creating and adhering to a well-thought-out investment plan can help mitigate the impact of emotional biases and ensure that decisions are based on a strategic, long-term perspective rather than short-term market fluctuations.

Conclusion:

A portfolio diversification comprises various asset classes chosen based on their relevance to your diversification needs. Understanding the nature of risks and returns associated with different assets in varying economic conditions and timeframes is crucial.

When constructing your portfolio, prioritize keeping your financial goals at the forefront. Invest in diverse assets for effective portfolio diversification, aligning with your risk tolerance and comprehension.

Managing your investments across different assets and maintaining appropriate proportions can be challenging. Seeking guidance from a professional financial planner is a prudent approach.

A financial advisor can provide expert advice, helping you formulate and implement a strategic financial plan and asset allocation tailored to your long-term financial goals.