In the ancient world, gold, being the oldest currency, held immense value and was widely accepted in exchange for various goods. Over time, its significance grew, and alternative metals with printed values on coins emerged as currencies.

The limited supply of gold, spanning various currencies and countries, contributed to its increasing value. Wealthy individuals began investing in gold, not only as a financial asset but also as a symbol of affluence and royalty.

Fast forward to modern times, gold remains a crucial component of household investment portfolios and gold investing gradually, despite its relatively lower liquidity compared to cash. It stands as a timeless asset with both historical and contemporary value.

Read: How to achieve your Investment Portfolio Diversification?

Why Gold Investing? Exploring the Benefits of Allocating to Precious Metals

Gold stands out as a dependable and appreciating asset, solidifying its position as a top investment choice. Often seen as a safeguard during financial uncertainties, individuals turn to gold for added security in challenging times, considering it a reliable alternative investment.

Here are the prime reasons and benefits to Gold investing:

1. Appreciation in Value:

Gold is always increase in its value over a long period of time, not only that, it is also able to retain its prices from going down too much. If somehow the prices of gold go down, it is always an opportunity to gold investing.

Similarly, what is presently happening in 2021, wherein, the prices of gold have come down by 15% or more, and investors are accumulating gold for the long-term gains in the prices.

2. Integral part of the investment portfolio:

Generally, gold has the priority in the anyone’s portfolio building exercise after, fixed income deposits. Because, the prices of gold are always going up and relatively easy to sell in the bullion market.

Furthermore, whenever someone sells its physical gold in the open market, it is bought at the prevailing prices of gold in the bullion market, except, jewelry. So, the selling prices are almost ensured due to extreme and permanent demand everywhere to gold investing.

3. Protection against the inflation:

Where there is a drastic rise in the prices of commodities and products in the economy, it is called inflation, the value of the different currencies also depreciates around the world.

Having gold in your portfolio, ensures that you protection of invested money and prices of gold only appreciates in that situation. It also called as hedge against the inflation, that is, it provides cushion to the investors to downside of their investments in other asset classes.

4. Value Protection against Crises, as a Safe Heaven:

When there are crises going on in the world related to financial sector, pandemic, war or any other crises, gold is always come to the rescue and protect your investment’s value in the markets and people start gold investing.

During the crises, most of the asset classes lose its value and prices goes down drastically, whereas, the value gold appreciates in the crises because it is considered as the safe heaven to invest and park your money after liquidation from other assets.

5. Helps in Diversification of your Portfolio:

As we discussed, gold as an asset provides one of the best options to invest your money and diversify risk from your portfolio. However, you should always invest according your financial goals.

Moreover, gold has the low correlation with other assets in terms of price movement, against equity and real estate. It provides downside protection as other asset classes goes down and stays firm, when other assets prices appreciate. So, it makes sense to invest in gold as an asset allocation.

6. Investing in Gold through small investments:

Even if you cannot buy gold with the small amounts of money, there are other modes to gold investing, which can provide you to invest gradually with the little amount of money.

For instance, Gold Bonds, Gold ETFs, Gold retail companies’ stocks, Gold mining companies, Sovereign Gold Bonds and others. We talk about these investment options in detail on gold investing.

Best Ways for Gold Investing

These days there several options are available to gold investing , gone are those days when only physical buying of the gold was the only option.

Here is the different type of ways to gold investing:

1. Buying of bars and biscuits as Gold investing:

You have the option to purchase physical gold in the form of bars and biscuits if you prefer not to invest in gold jewelry.

Designer jewelry involves additional costs in the making, reducing potential profits in the future. With bars, there are no extra costs, and when you decide to sell, you receive the full prevailing prices.

However, if you’re celebrating a wedding or a festive occasion, buying gold jewelry might be necessary. Just be mindful not to go overboard, as storing excessive jewelry in a bank locker can incur maintenance costs each year and there are making charges too.

2. Gold ETFs:

As in the case of, equity ETFs, the gold ETF tracks the price of the gold and changes its NAV accordingly. It is passively managed fund, which is based on the prevailing prices of the gold. The units of the ETF you bought are stored electronically in the Demat form, which is perfectly safe.

Moreover, it is low cost buying the gold price and there are no locker charges involved to maintain it. Additionally, because there is no minimum quantity you have to buy as in case of physical gold, it can be bought in the smaller investments by retail investors.

3. Gold Bonds:

Similar to ETFs, gold bonds are available in the digital form, as in the case of saving bonds. All the features and of the ETFs applies here also. Additionally, gold bonds are available at relatively at a lower cost or charges on gold investing.

However, gold bonds are not freely tradable as there are minimum period to remain invested, generally 5 to 7 years and accordingly the long-term capital gains are taxed applies here.

In India, there is gold bond scheme called ‘Sovereign Gold Bond series’, which is directly offered from RBI, the central bank of India.

According to me, it is a best option of gold investing, instead of buying physical gold. Also, if you do not want to have lock in period, you can also buy Gold ETFs.

Here are some of the significant benefits to invest in Sovereign Gold Bonds:

- The quantity of gold is protected, as investor will receive the ongoing market price at the time of redemption/premature redemption.

- The SGB offers a better alternative to holding gold in a physical form. The risks and costs of storage are not there.

- Investors are assured of the market value of gold, at the time of maturity and periodical interest (2.5% interest).

- SGB is free from issues like, making charges and purity, as in the case of gold in jewellery forms.

- The bonds are held in the register of the RBI or in the Demat form, which, eliminates risk of loss of scrip.

4. Gold Mutual Funds:

It again similar to gold ETF, however, there are some differences, as follows:

- There is minimum amount you have to invest in the gold mutual funds, which is Rs.1000 in the month, while Gold ETF require to buy equivalent to at least 1 gram of gold unit.

- Unlike, Gold ETF, in the gold mutual funds, you can invest through SIPs, as per your convenience and not require to invest all at once.

- As a mutual fund scheme, you do not have to open a Demat account to buy a gold mutual fund, still your units will be stored digitally with the registrar.

However, you can expect the similar returns of the ETFs, as the underline prices remains as per bullion market.

5. Buying the Stocks of Jewelry Retailer:

There are few of the listed companies, who sells gold and gold related products. You may buy these the stocks of those companies who do businesses as value add on gold investing.

However, the stock of a company, will nothing to do with the gold prices or you cannot claim the stock price similar to prevailing gold price.

Only thing is that, if there is rise in the prices of the gold, these companies gain on the price rise for stock or gold they already bought earlier at lower prices. Moreover, if there are festive or wedding season, they grow their sales and get lot of making chares as the margin over the physical gold prices and other value-added products and ornaments.

Gold as an asset class for Portfolio management:

As we’re aware, gold plays a crucial role in many investor portfolios, offering stability and acting as a hedge against inflation. Gold emerges as the optimal asset class to counter these trends and bring stability to your portfolio.

We understood that why gold should be the part of your portfolio, but how much allocation should be made as a part of our portfolio?

Well, that depends on lot of factors and situations which everyone is in. For instance, your risk tolerance levels and age are the central factors to consider for building a portfolio and gold investing .

To learn about investing raise query here.

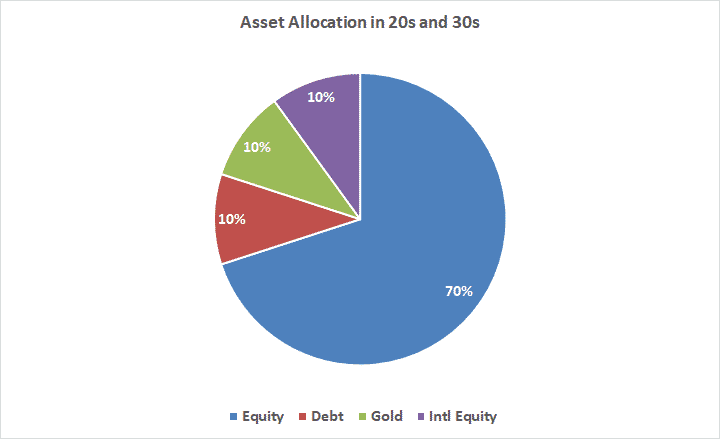

If you are in your early 20s and 30s , you may want invest money in little more risky assets like, equity, however, still you may need to have 10 to 20% of the allocation to the gold.

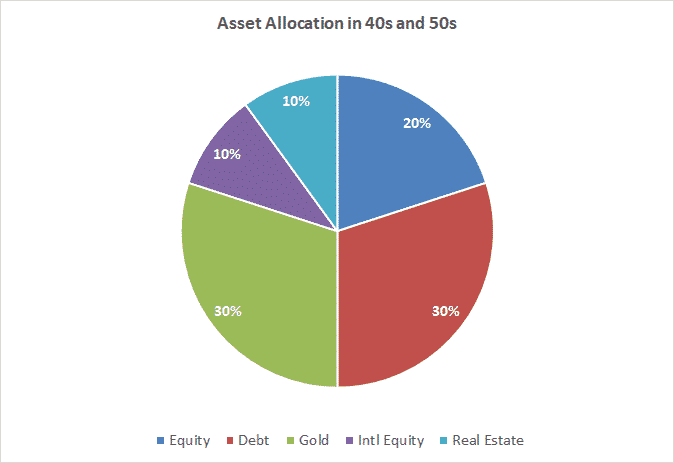

On the other hand, someone is in their 40s and 50s, may want to good amount of exposure towards gold as an asset class for portfolio building.

Here is a depiction of the portfolios, according to the age:

While at the age of 20 to 30 years, you may take sizable exposure in equities between 70% to 80%, as you do not have much of the financial responsibilities and may take higher risk with your investable amount.

In this age group the asset allocation may look like as below:

On the other hand, someone is in their 40s and 50s, may want to good amount of exposure towards gold as an asset class for portfolio building.

As you can see in the above graphs, gold may form a significant part into your portfolio at every walk of life.

However, you should be aware of the about the down sides of the gold as an investment. You should refer to the price trends of the gold in the long term and accordingly do gold investing .

Here is the long-term trend of the Gold prices over last 3 decades:

Gold Returned CAGR of 3.23% (COMEX Index)

As shown in the above trend graph, although the gold provides stability to the portfolios, but do not provide best of the returns over along period of time. For that, you should look towards other asset classes.

Thus, it is suggested to not to go overboard while gold investing as investments and learn to diversify your investments across different asset class, as per your need and return expectations. But, gold as an asset class should be considered as in option even for a ‘rainy day’, because when nothing left valuable, Gold would definitely be recognized as precocious, as it was thousands years ago.

Conclusion:

Gold investing, a timeless marvel, has fascinated humanity for centuries, and its enduring allure remains. With limited supply and constant demand, it serves as a natural hedge against inflation, maintaining its value over time. As a pivotal component in every portfolio, the significance of gold steadily grows.

Embracing gold doesn’t necessarily mean acquiring physical gold. Accessible options like gold investing ETFs, Gold Bonds, and Gold mutual funds democratize gold investment, making it feasible for all.

For nations reliant on gold imports, opting for paper gold options is strategic. It conserves foreign currency, trims fiscal deficits, and channels resources into national development and citizen welfare. It’s not just an investment; it’s a step towards a prosperous future.

However, if you seek not just preservation but active wealth growth, equities act like seeds that grow into mighty trees, providing shade and prosperity for years to come. It’s a journey of preserving with gold and growing with equities, ensuring your financial landscape flourishes.