For individuals keen on entering the stock market after witnessing their peers’ successful ventures, the choice between mutual funds and stocks becomes a significant dilemma.

Questions such as the optimal investment amount and the best approach to stock market investment often arise.

To address these queries, we’ll explore 15 key differences between mutual funds and stocks, assisting you in making an informed decision based on your preferences and financial goals.

This comparative analysis is designed for both beginners and seasoned investors, providing insights for immediate investment without the need to wait for the perfect timing.

Before delving into the mutual funds vs stocks discussion, it’s crucial to understand the underlying reasons for venturing into the stock market.

Why should you invest in stock market?

We all aspire to achieve financial prosperity for a comfortable and enjoyable life. Individuals pursue various paths, from rewarding jobs to becoming professionals like lawyers, doctors, finance experts, or tech specialists.

While many find success in these roles, the pinnacle of wealth often lies in entrepreneurial endeavors. Unlike salaried positions, a successful business has the potential for limitless income and scale. Companies like Walmart, Nestle, Google, Microsoft, Apple, and Tesla exemplify the immense wealth that can be generated through business ventures.

Yet, embarking on a business journey introduces uncertainties, particularly when transitioning from a steadily growing job with consistent year-on-year pay increases.

What if I told you that you could maintain your regular income streams while also becoming a small owner of the aforementioned companies?

Moreover, you can become a shareholder in 50 to 100 of the largest companies in your nation and even globally.

This is the primary goal when you buy a stock or share in a company – to become a small owner by investing a fraction of the money its founders paid to start the company.

What’s even more significant is that you’re purchasing ownership or equity in the company. Furthermore, you don’t have to actively work for the company or contribute to its growth; you can simply be a consumer.

As the company’s business expands, the stock price generally increases. Additionally, many companies regularly pay dividends to shareholders, often providing better returns than traditional bank deposits and with tax advantages.

How did stock markets perform in the past?

Before investing in any asset class, we should also see the past records of its performance in terms of returns on the investments we made.

Here are some of the market Trends seen in last 3 decades: –

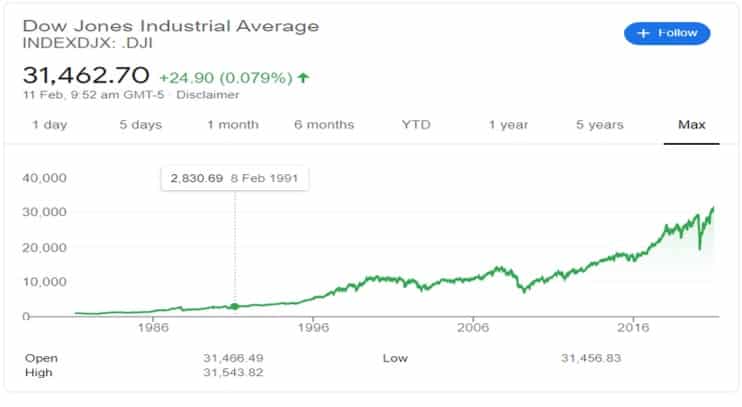

Dow Jones Index CAGR returned 8.36%

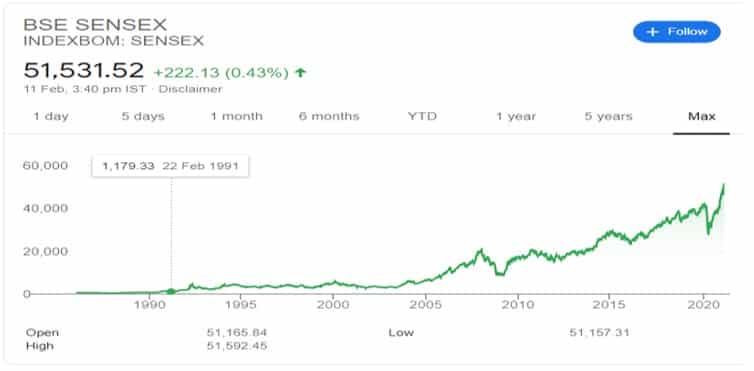

Bombay Stock Exchange, India returned 13.42%

Gold Returned CAGR of 3.23% (COMEX Index)

As the above market trends suggests, equity markets have outperformed other asset classes by a significant margin. However, in the short period of time, there could an exception to this trend.

Advantages of investing in Equity Market

There are many benefits of investing in the stock markets, but all of those advantages realized mostly, if someone is investing for long period of time, say, 7 years or more and as far as 40 to 50 years, as per their risk tolerance of the investor.

1. Get an ownership in the big corporates:

The biggest advantage of buying a unit of stock, provides you a small ownership of a blue-chip or a multinational company. Which simply means that your investments will grow as the business of that company grows in the future.

As the name suggests, buying a share of a company, brings you the part of the profits to you in the form of dividends, bonus shares, moreover, the price appreciation of the stock benefits with the capital gains, if the company is showing promise for its business.

Additionally, a shareholder has voting rights for the vital decisions of the company, over the people, who runs the corporate.

Even if you invest in an Index fund or ETF, you can get the part of ownership of multiple companies and gain as the index price of NAVs grows.

2. Best return on investments:

As mentioned earlier, the stock market has consistently rewarded investors more than other asset classes over the past decades. The comparison between mutual funds and stocks for better returns is another ongoing discussion.

Especially in the long term, equities deliver the best returns and mitigate uncertainties associated with short-term risks such as wars, natural disasters, financial crises, pandemics, frauds, and more.

While these risks can cause significant market fluctuations, over time, situations are typically managed, and people’s sentiments normalize, leading to an uptrend in stocks once again.

4. Convenient and Cost-effective method to invest:

Investing in real estate property and gold jewelry comes with high transaction costs during buying or selling.

Additionally, the associated paperwork and due diligence often require legal professionals, incurring even higher expenses.

In contrast, transactions in the stock market involve significantly lower costs. Brokerage fees and state taxes, often as low as 0.10%, make stock market transactions more cost-effective, especially when buying Exchange-Traded Funds (ETFs).

5. Equity is one of most liquid among long term assets:

As mentioned in above paragraphs, equity is most convenient to transact at a click of a button, but also, there is always a regulation from security regulator that how much time the money has to be transferred to a seller.

It varies form 1-3 days in stock transactions, while, assets like, art, land and real estate, it can take few weeks to months, before realizing 100% sold value.

6. Most Tax efficient asset:

Equity investment attracts the lesser tax liabilities than all other types of income or capital gains. This could be because the governments want to invite more equity capital into the stock markets and flourish corporate financing by itself.

And tax savings preposition into mutual funds vs stocks is also a point where, ELSS MF schemes considered as tax saving vehicle, in some countries like, India, to encourage people invest in stock market.

7. Grow your money more than inflation:

If you invest most of your money in savings account, bank fixed deposits or even bonds, at most, it will provide returns equivalent to inflation rate or even lesser.

Real returns are total returns minus inflation. The saving deposits does not deliver you the protection against inflation, you need earn more than the inflation, to secure yourself financially from future costs of living.

Equity is an asset classes, which has provided real returns of 4-8% depending upon geographies, to the long-term investors, as it resumes the up trends after short term market undulations.

Indirect way of Stock Market Investing

In case, you are not well versed with the investing of financial world, there are solutions provided by different service providers, namely, Asset Management companies, Portfolio management Services and Stock exchanges.

Majorly, these service providers invest your money by charging a small amount of consultation or fund management fees. Before discussing mutual funds vs stocks, we go through other investing options available.

Nevertheless, you want to invest your money in equity markets, following are the avenues of passive investing available in every country:

- Mutual Funds

- ETFs.

- Portfolio Management.

- Index funds.

- ULIPs.

1. Mutual funds –

Mutual funds are the pool of investors, who contribute funds to an Asset Management company for a common objective. Where, a fund manager invests your money in different stocks, after performing fundamental, technical analysis and keep an eye on different market scenarios.

2. Exchange Traded Funds (ETF) –

These are similar to mutual funds, but track a particular Index, such as, S&P 500, Nifty50, Nasdaq 100 or others and invest in same collection of stocks and in similar proportions. ETFs can be traded on exchange any time for buying or selling. Generally, ETFs are low-cost investment vehicle as opposed to MFs, PMSs and Index funds.

3. Portfolio Management Services (PMS) –

This is again a service where, as per your risk profile, a PMS manager, develops a customized portfolio of stocks, which could not be performed under, mutual funds and ETFs.

There is a little higher fee, according to your expectations of returns on investments (ROI) and can be a minimum threshold of ROI with conditions, if you so desire.

4. Index Funds –

Similar to ETFs, invests your money passively, into a particular stream of collection of stocks, with a difference that Index Funds could not be traded like, stocks and ETFs, during the trading day. Also, index funds are having less cost than MFs and PMS.

6. ULIP (Unit Linked Insurance Plan) –

As the name suggests, these are the Insurance plans having a component of equity investing in stocks or Index. Similar to MFs, there are generally the fund managers to manage the money invested by the policy holders of the Insurance plans.

It is to be noted that securities markets are regulated an agency generally affiliated by Government of respective countries. For instance, SEC in U.S and SEBI for Indian capital markets to protect the rights of the investors from several risks and frauds.

Focusing on buying Mutual Funds and Stocks

Two of the most heard paths by retail investors to invest in the stock markets are mutual funds and stocks. Both are the options meant to invest in the stock market of any country.

If these are the best options to invest in the equity markets, along with ETFs and Index funds (which are the extension of indirect way of investing) then, which one should be chosen between mutual funds vs stocks to invest in.

First, we will understand, what is mutual funds and stocks? and how those are different to each one?

What is Mutual Fund?

Before investing anywhere, we should understand what it is, its risk factors and nature of functioning, also, will it be suited to our investment objectives and risk profiles.

Mutual fund is pool of funds contributed by investors, for a common objective of capital gain or profit from the avenues, such as, stock market, Bonds, Government securities and money market.

Also Read: Best Mutual Funds to invest in 2021

Why Mutual Funds?

Mutual funds are run by Asset management Companies (AMCs), who hire best of the qualified and experienced professional from the investment world, to manage and invest your money in above mentioned investment avenues by charging a fee.

The main objective of these Fund managers is to beat the underlined Index, for instance, BSE Sensex, Nifty 50, Nifty Bank, Nifty top200 and others.

Importantly, these full-time fund managers invest your money in best quality stocks and fixed assets, and make profits for you more than the plan vanilla Index, those extra gains made are called Alpha.

These fund managers perform fundamental, quality analysis and technical analysis, of the securities they invest on your behalf and regularly track those companies’ financial health and growth. This are called actively managed funds.

Type of Mutual Funds

There are several types of mutual funds, and distributed into different categories depending upon the risk factor and targeted assets to invest in. Some of the most popular of those are mentioned below: –

Equity Mutual Funds:

| Types of Equity Mutual Funds | How they Invest |

| Large Cap Funds. | Mainly invest in top 30 or 50 Large companies according to market capitalization |

| Mid Cap funds. | Mainly Invest in Mid-sized companies, from 50th to 250th accordingly to market cap. |

| Small Cap funds. | Mainly Invest in Smaller sized companies, beyond top 250 companies accordingly to their market cap. |

| Multicap funds. | Invests in all the above-mentioned type of companies with equal limits. |

| Flexi Funds. | Invests in all the categories of companies and make changes according to market situations and economy. |

| Hybrid Funds. | This has a mandate of investing maximum of 60% in equities, rest in Fixed income assets. These are also called as balanced funds. |

| Asset allocation funds. | Here, investments are allocated to different asset classes, like, stocks, bonds, Gold and others. |

| Sectoral Funds. | Invests in a particular sector companies, such as, Finance, Technology, FMCG, Infrastructure and others. |

| ELSS Mutual Funds | Equity linked saving schemes are the tax saving mutual funds, perform similar to Large cap Funds but have the lock in period. Choose best ELSS funds of 2021 |

Direct Equity or investing in Stocks

As the term suggests, we directly buy the shares of a company from a stock market with the help of stock broker, as described earlier.

Fundamental Analysis

Firstly, all the responsibility of selecting a particular stock or basically, company, by way of information gathering and analyzing lies with you.

This information is called Fundamental analysis and may include, but not limited to, the following:

- Understanding the business, such as, its products, market demand, Brands, age of the business, segments it works in and more.

- Its financial analysis, for instance, going through the balance sheets and profit and loss statements, to gather information about, debt situation, revenues growth, profitability trend, to name a few.

- Moreover, check the management quality and their track record, whether they were able to run a business successfully in the past, also, qualified.

- Mainly, if you can tell yourself about the company, regarding about their products, brands, how long you have been using, is it having products or services which your friends and family also endorse to use.

- Further, there is price discovery of a stock based on growth and profitability of the business, price which you will pay for one unit of stock.

Fundamental analyses is mainly a qualitative analysis of health of a company, which can be done before buying the stock. However, there are many other parameters on which the due diligence should be done, such as, legal or fraud matters in the company.

Technical Analysis of Stocks

Secondly, there is a technical view of a stock, called Technical Analysis, based on data available, which is mainly try to predict the price of a stock into the future for a short period.

Technical analysis is based on the past price trends and the volumes in a particular period from a chart of a stock. There are many probabilities and techniques, to gauge the future price movement for day, week or month.

Based on the analysis, the stock traders, take a call, whether to buy a stock or sell, if trends reflect so. However, this analysis-based stock picking is not advisable unless, you are proficient in the techniques and actively buying and selling the stocks, when trend triggers.

Mutual Fund vs Stocks

As we have understood what is mutual funds and investing directly in the stocks, now we can proceed for the comparison and which one is the best option to invest and for whom?

Here are some of the major differences between mutual funds vs stocks investing:

| S.No. | Mutual funds | Buying Stocks directly |

| 1. | This is the indirect way of investing in the stock market. | This is direct way of investing in the stock market. |

| 2. | MF fund manager does the fundamental and financial analysis of stocks for you. | You do the fundamental and financial analysis yourself of the stocks on you want to own. |

| 3. | You pay a fund manger fees on the amount you invest in MFs. | There are no extra charges of fund manager, only transaction charges are paid here as a brokerage. |

| 4. | You do not do portfolio allocation or changes in stocks selections | You have to be agile to make changes in the portfolio based on market conditions and new opportunities. |

| 5. | You do not have to be very knowledgeable to analyze stocks and securities to invest. | You have to be having good knowledge of finance, investing and business to invest in any stock. |

| 6. | You just have to devote some time once of twice in a year to check the performance of MF schemes and re-invest if needed. | You have to be analyzing the stocks in your portfolio at least in a quarter, if not monthly and be updated on the business & economic updates to take investment decisions. |

| 7. | An MF scheme automatically diversifies your funds into different stocks and sectors. | Here you have to take care of the number of stocks and sectors to well diversify your portfolio. |

| 8. | You do not have to do much of the readings about economic news. | Direct stock investing requires you to read journals, books, magazines, blogs and websites, to get the in-depth information about investing |

| 9. | You can invest in mutual funds directly by analysing MF schemes yourself or indirectly through a MF advisor (Regular pathway). | Here you can get the research reports and recommendations about different stocks, from your broker or other channels and take decision to invest. |

| 10. | If you are having multiples MF schemes, then you can take advice from a mutual fund advisor to analyse the performance or changes in the MF portfolio. | As there are many stocks listed, the stocks advisors may not be able to advice on each stock you have, then you have to analyze it yourself, by gathering information about it and buy or sell if required. |

| 11. | Mutual fund investing is recommended for all the investors of any kind, such as, retail, HNIs and Institutions for better than Index returns in the long period. | Direct stock investing is recommended for the investors who are ready devote time, preferably fulltime, and have deep knowledge of finance, to analyse the stocks and take high risks and high rewards. |

| 12. | There is may be a situation of over diversification in a mutual fund scheme, due to many stocks from 20 to 60 in a single scheme. | Here, as you can pick an choose the number of stocks you want to invest in the chances are that you develop a focused portfolio which will beat the mutual funds scheme by a good margin. |

| 13. | Mutual Funds schemes like, ELSS, can save you tax with lock-in period of three years. | No tax saving options available for direct stock investing, but tax treatment is the same for both. |

| 14. | There is a exit load in MF schemes, if you sell units before a particular period. | No such load is charged here. |

| 15. | You can start investing in mutual funds with a common minimum amount of Rs.500 | You can invest in a stock with at least one unit of share, which may vary from Re.1 to Rs.90K |

However, if you do not want or able to select between the mutual funds vs stocks to invest in, then you can straightway invest in an ETF or Index fund, these funds invest you money in an Index such as, Nifty50 or Sensex and in the same proportion of the stocks.

This way you do not have to go to a mutual fund advisor and an equity broker for top stocks and take extra risks, but still can get the benefit of the equity markets returns, get diversification automatically and do not have to analyze the selection every now and then.

Conclusion:

Choosing between mutual funds and stocks demands careful consideration of their unique attributes. The 15 differences highlighted provide a roadmap for savvy investing.

Whether favoring mutual funds for diversification or stocks for direct ownership, align your strategy with goals and risk tolerance. Regularly review and stay informed for lasting financial success.

In this journey, smart decisions and commitment to goals will pave the path to a prosperous financial future. Are you ready to invest in the stock market smartly and achieve your financial goals?

Disclaimer: This is not a direct advice to anyone. Do consult with your financial advisor for your investing decisions.