There is a possibility of risk occurrence in every walk of life. Some of those risks can be life threatening, such as, major injuries or even death.

All those catastrophises may have financial implication associated with it. If the life in question, is having an economic value, that is, the person or the asset is earning income for him and for the dependents, then it may have further repercussions financially.

With respect to ensure your financial security, one always have to be mindful of the risks he may face during different life situation. It may be related to a human life or the assets you possess.

One should list down some of the important risks, which may have possibility to occur, and can derail their financial future, at any point of time in the life and attach a risk management plan to ensure your financial security.

The things that you should understand is that, dying too early and living too long are the biggest risks in everyone’s life.

Both of those can be financially challenging and difficult to recover from. Also, major health issues and damage to physical assets, may further expose to the financial difficulties.

Here are the measures to ensure your financial security

Personal finance risk management starts from ensuring the short-term obligations, with respect to paying regular bills, near term expenditures spread over a year and finally, towards the longer-term commitments.

We will gradually discuss on the risk management to ensure your financial security from immediate to long standing goals.

1. Emergency or liquid Household Fund:

The most important fund, we all need is an emergency fund, which should always remain in cash or cash equivalent deposits or in liquid form, available for immediate disposal.

The emergency fund should be created as a contingency fund against the risk of losing a job or loss in the businesses, so that, this fund comes to rescue for some period for your family to ensure your financial security.

This sum of emergency fund varies for each one of us, depending on our lifestyle expenses. Thus, you need calculate your monthly household expenses, such as, groceries, rent, transport, school fee, including those, which occurs in a year.

For instance, car service or premium payment of insurance, may not be a monthly expenditure, but those need to be included in the monthly expense list, proportionately.

Resulting, you will come to know about a monthly figure, which is your average 12 months expenditure. Now, you need to have reserves of at least 6 months to 9 months expenses as an emergency fund.

So, multiply above monthly figure with 6 or 9 depending upon the vulnerability of you jobs or business risks, to pay your household bills for that period, whilst, you search for next employment opportunity.

2. Life Insurance for risk of ‘Dying too early’:

First and foremost, one needs to have risk cover for his or her precious economic life because, there may be lives depending on that one and to ensure their financial security.

There can be lot of dilemma, while selecting a best life insurance policy for you, which will cover the risk in case of a death of the income generator in the family.

So, here, we are talking about pure life insurance risk cover, not an investment plan. Thus, it is important that you buy a Term life insurance policy to get maximum amount covered in lowest possible cost to ensure your financial security.

You may also add an accidental death cover, which costs in fractions but doubles up the death cover, in case the death happens due to an accident.

Term insurance is really important, in case, death occurs in just few years after taking the policy of bread winner in the family, the insurance company will pay full amount, as per agreed sum assured or the amount of insurance, to the nominee or a family member.

I have made a detailed note on this cause, that how to buy a life insurance for you.

What you should keep in mind that there are several types of Life Insurance Plans available in the market, some of those basic plans are mentioned below:

- Endowment Plans.

- Money Back Plans.

- ULIPs (Unit linked Insurance Plan)

- Whole Life Insurance.

- Child’s Plan.

- Whole Life Policy.

It is clear that from above list, when so much of life insurance plan offered in the market, it is difficult to ascertain, which one should you take.

Most importantly, it is the Term Insurance Policy which is needed, for as much as risk cover at a much lower cost, as compare to above mentioned names. Also, refer: how to buy a life insurance for you.

Even if you already have so much of endowment plan, you will not be enjoying much required financial security for your loved ones. So, if there are more than one endowment plan you have and close to maturity, barring that, you should shift rest of plans to term insurance plans.

As the insurance companies and agents do not get much of a revenue from term insurance policies, it less promoted and last to talk about during a sales pitch to a perspective buyer.

Typically, you must have 12 to 15 times of your annual income insured value of risk cover to ensure your financial security.

3. Health Insurance for Medical Emergencies:

Hospital expenses can be exponential for curing a major injury or a life-threatening disease. A health insurance policy can save you from that huge bill shock.

Heath insurance policy can be bought for the whole family in a single policy or at individual level. While buying a health insurance policy it is important to check the exceptions and conditions.

Additionally, it is very important to check the company track record, in terms of claim settlement ratio. That is, in how many cases, the company has given the claim to the policy holders or to the hospital in case of cashless claim, that should be upwards of 96%.

In addition, you may also want to take a critical illness cover, with little more money to cover from listed illnesses, which may cost bigger amount of bills, for hospitalization or major surgery.

Important point here is that, buying family health plan for a younger family, is a good idea to start with, however, as the age of the parents grows, it is prudent have individual health plan for each family member, to further cover the risk from health issues at a later age.

4. Medium Term Backup Fund:

Similar to the emergency fund, this fund is also calculated based on the monthly expenses of a household. But the amount should be accumulated for 12 to 18 months of your monthly expenditure.

However, there are two main differences, which makes it a fund created for over and above near term or regular expenses:

Firstly, this amount is not required to remain in a liquid or cash form but in a bank fixed deposits or similar avenue, but with the option to withdraw in few days of notice.

Also, as a fixed investment avenue with low risk of loss of capital, this amount should be invested in bank fixed deposits and top-rated medium-term Debt mutual funds. Those will earn more interests and capital gain, than the cash or saving account and grow bigger corpus of money in some years to ensure your financial security.

Secondly, this fund should not overlap with any other medium-term goal, like, vacations, buying a car or even investing in stocks or real estate. This will also form part of your fixed income asset allocation, wherein, you may invest at least 20% to 50% your income.

Lastly, this is a peace of mind, created for an even worst situation of not getting employed in 6 to 9 months but still living comfortably or facing a sudden high value fund requirement.

5. Insurance or Child’s saving plan:

There is more of an emotional factor attached, to a child’s future and their financial needs at a different stage of life. Every parent wants ensure enough funds for the education, marriage, business, and others, for their child.

The objective of a child plan is to provide financial security to the child’s financial wellbeing, but child is not generating income, it is the parent who are earning income and continue to do so till their goals are met.

Thus, it is the parents who should be sufficiently insured by way of getting term insurance as early as possible, thereby, putting spouse or child name as a nominee for the claim amount.

Most of the plans sold in the market have the component of risk cover and a saving plan. Neither those offer much needed life risk cover, nor provides enough savings to meet the prime goals for the children, as the premiums of this combination are much higher for the parents, but pushed by insurance companies.

Therefore, you should take optimum risk cover by taking Term Insurance plan and pursuing long term investments plans, such as, mutual funds, stocks, gold, even bonds for considerable returns on your investments, to ensure your financial security.

6. Retirement Planning for risk of ‘Living too long’:

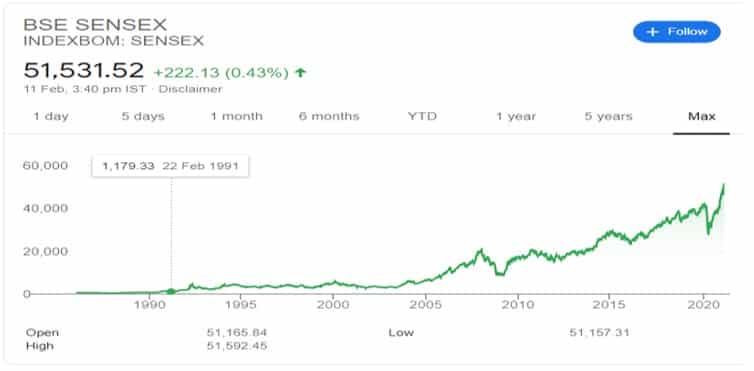

Bombay Stock Exchange, India, returned 13.42% over last 3 decades

Well, I am still young and just started to generate income, I want to enjoy life and buy a car and expensive gadgets for entertainment. This is the notion most of the young people have, they have started earning but do not want to invest for their old age because it is too far away.

In building big wealth, time is the most important factor, as, there are several decades required to grow your invested money and multiply it and to ensure your financial security.

Compounding is the essential enabler for an investment to grow manifold, for that, you need to stay investment for a long period of time.

Retirement is the financial goal, in which people have longer available time, to achieve bigger corpus of money. If you have started earning in early 20s, then you have at least 4 decades to invest and multiply your money.

Thus, to take the benefit of time, you should invest in riskier assets initially, having best rate of return on your investments. One the most important investment you can opt is Equity, by way of stocks, equity mutual funds, ETFs and Index funds, to ensure your financial security.

Furthermore, you can also compare the past rate of return of different investment classes. Equity market in India has given the best returns of 14% in the last three decades, whereas, an endowment plan, money back plan and alike, has just resulted in approx. 5.5% of returns.

As we all know, governments cannot support much at your retirement, it is you who has to take responsibility of your old age. I take an example here and its calculation, by which you will easily understand more about Compounding and time value:

| Stages | Joy | Roy |

| Started investing at the age | 20 | 35 |

| Amount invested each month | 2000 | 18500 |

| Target Retirement Age | 55 | 55 |

| Invested till the age of | 40 | 55 |

| Rate of Return | 12% | 12% |

| Total Amount Invested | 480000 | 4440000 |

| Years of money invested | 20 years | 20 years |

| Amount Accumulated @55 | ₹ 1,84,05,002 | ₹ 1,84,84,237 |

Explanation:

- It is astounding that Joy just invested 2000 bucks per month for his retirement goal, whereas, Roy had to invest over 9 times of that money each month to match the similar retirement amount.

- More importantly, Joy just invested 4,80,000 and Roy had to invest 44,40,000 for the same result.

- Joy started investing at an age of 20 but stopped at 40, and still required much less invested amount, for the similar retirement corpus of Roy.

- Joy could invest rest of his money for much bigger wealth for his other financial goals and live financially free, much before Roy anticipated.

Biggest takeaways from above example are:

- You should start investing as early as possible. Warren Buffet started investing at an age of 11 and became the biggest investor of the world and top of the richest people.

- Allow invested money to compound by not withdrawing but adding more on regular basis and with each increment in your income. Compounding is the 8th wonder of the world, said by Albert Einstein.

- You can start investing with small amount and never wait for enough income to invest.

- Time and patience are your biggest assets to build tremendous wealth for you and to ensure your financial security.

7. Increase your savings, control on expenses and Invest more:

Most of the people are having limited sum of money, that should be utilize in a best possible manner. Think before buying high ticket items, save first and then spend to ensure bigger savings. Make a budget and track your expenses by planning and automations.

Moreover, try to limit your leveraging and taking loans or credit card spends, for shopping and buying high value things, because, leveraging brings unwanted additional costs. Conversely, buy needed things from the profits from your investments instead of taking debt.

Additionally, increase your savings with every legitimate possible opportunity to earn extra income by improving and re-skilling with newer technologies as per future job requirements.

This way you will increase your investable amount and invest more for long term. Also, automate your investing methods, such as, Systematic Investment Plans for auto investing regularly to ensure your financial security.

Bottom line:

As described, in this piece of writing that your financial risk management starts from taking risk cover against unexpected events in life, pertaining to unexpected death of an income generator and health emergency in the family, which may derail your financial health and threat to your future living standards.

Furthermore, a backup sum of money for rainy day and mindful of your net worth by growing your money through saving more and investing in different asset classes for diversification of your investments and learning about investing to ensure your financial security.

Finally, you may also consult to the certified financial planners for an expert and customized approach towards your financial security and achieving your future financial goals.

Disclaimer: Please consult with your financial advisor for all your financial decisions, this content is written for information and not a direct advise to anyone.

Read Standard disclaimer for all the content written on this website.